Introduction

There has been an increase in crypto adoption across regions globally. According to a report by TRM Labs, cryptocurrency continues to show a significant trend of adoption growth worldwide. Some regions, such as Latin America and Southeast Asia, have seen a tremendous surge in usage. In Latin America, cryptocurrency adoption is driven by the challenge of high local inflation, prompting people to turn to digital assets as an alternative hedge.

Meanwhile, in Southeast Asia, the increase in adoption is largely due to the increasingly tech-savvy young population and the development of a blockchain-based payment ecosystem. Countries such as the Philippines, Indonesia, and Vietnam are hotspots, with a growing number of crypto users every year.

In Europe, many developed countries, such as Germany and Switzerland, have begun to integrate cryptocurrency into their financial sectors, including banks and investment institutions. This provides further legitimacy to the adoption of crypto as a means of transaction and investment.

Africa also shows great potential, especially in the sub-Saharan region. Adoption in this region is largely driven by the lack of access to traditional banking services. Cryptocurrency provides a solution for accessing cross-border transactions at lower costs.

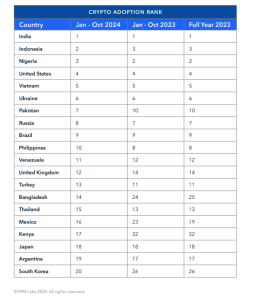

This information is reflected in the TRM Country Crypto Adoption Index data, which shows the ranking of cryptocurrency adoption in various countries for the period of January to October 2024.

The community also plays a significant role in driving the growth of crypto adoption in Latin America, Southeast Asia, Europe, and Africa. Crypto communities in various countries drive innovation, adoption, and education within the ecosystem. Additionally, crypto communities allow market players from various countries to gather in a safe space to interact with founders and team members. This helps build trust, as community members can help clarify issues and reduce the risk of fraud.

Through this research article, AllSpark Research, based on the TRM Labs report and several other reports, aims to understand how crypto adoption is developing across demographics and regions. This article will focus on community factors. Furthermore, the report also provides insights into global crypto adoption trends and associated risks, to support community growth in various countries. This article covers everything from regional trends and adoption patterns based on demographics to examples of successful communities that help raise awareness of the use of crypto.

Regional Trends in Crypto Adoption

Cryptocurrency adoption is growing rapidly, with unique patterns across regions. Southeast Asia leads with high cross-border transactions, while the United States is driven by institutional investment. Africa leverages crypto for remittances and financial inclusion, while Latin America sees it as a hedge against inflation.

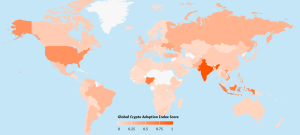

The drivers for each region vary. Southeast Asia is fueled by broad access to technology, Africa by the need for alternative financial systems, Latin America by the pursuit of value stability, and the United States by innovation and regulatory support. This pattern reflects how crypto meets the unique needs of each region. The following image is the Global Crypto Adoption Index Score from Chainalysis, showing a map of the world with color codes representing adoption scores.

a. Southeast Asia

According to the TRMLabs report, one of the countries in the Southeast Asia region, Indonesia, ranks second in crypto adoption, surpassing Nigeria. This significant growth is attributed to widespread adoption of technology and increasing crypto transactions across sectors. The growth of digital infrastructure has made Indonesia one of the most fertile grounds for crypto adoption.

Similar to the TRMLabs report, the latest report The 2024 Global Crypto Adoption Index Top 20 from Chainalysis states that Thailand, the Philippines, and Vietnam are leading cryptocurrency adoption in Southeast Asia and globally. Several key factors behind crypto adoption in Southeast Asia include technological innovation and financial inclusion.

Countries such as Singapore and Thailand have advanced with a positive approach to developing technologies such as blockchain. These nations also facilitate the growth of various cryptocurrency projects and create a safe environment for technological innovation. Cross-border crypto transactions and broad access to technology further strengthen crypto adoption in Southeast Asian countries

b. United States

According to the TRMLabs report, the United States is one of the leaders in crypto adoption. The main reason is a combination of clear regulations in certain regions and high adoption of blockchain-based technology. The United States also demonstrates innovative activity in the DeFi and NFT sectors, attracting institutional investors’ attention.

In the United States, institutional interest in investing is reflected in the increasing inflows into Bitcoin spot exchange-traded funds (ETFs). Institutional investment interest is also evident in the adoption of Bitcoin by many traditional financial institutions, such as banks.

Several major banks in the U.S., including Morgan Stanley, Goldman Sachs, and Chase Bank, have embraced crypto adoption. In 2015, Morgan Stanley began offering wealthy clients access to Bitcoin funds, making it one of the first traditional banks to do so.

c. Africa

Nigeria ranks third in global adoption after India and Indonesia, according to a TRMLabs report. The main drivers are the need for faster and cheaper cross-border transactions and efforts to protect assets against high inflation. The use of crypto as an alternative payment method is a major trend.

According to Chainalysis, a blockchain monitoring firm, about 33% of Nigerians are invested in cryptocurrencies. Nigeria is Africa’s largest economy and has consistently ranked at the top of global crypto adoption rankings. The country has been the largest crypto adopter since the second quarter of 2022.

Apart from Nigeria, crypto adoption in Kenya is also high. Kenya has shown the largest increase in the African region, with crypto transaction volumes doubling compared to 2023. Kenya is embarking on a regulatory push for crypto, with the government forming a multi-agency team that includes the central bank.

d. Latin America

This region shows strong adoption potential, although it does not rank in the top ten. Brazil and several other countries continue to demonstrate interest in crypto adoption, particularly to address economic challenges such as inflation and limited access to traditional banking. A major focus in the region is how regulation and economic needs are driving higher crypto adoption compared to other regions in the world.

Brazil consistently ranks among Latin American countries with the highest crypto adoption. In addition to its focus on crypto regulation, Brazil’s central bank is also developing its own digital currency, known as DREX. This currency is expected to play a significant role in Brazil’s crypto asset ecosystem.

Adoption Patterns Based on Demographics

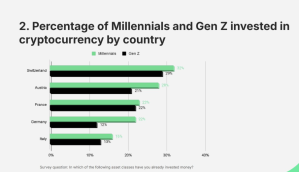

In the adoption pattern based on demographics, Millennials and Gen Z dominate cryptocurrency adoption thanks to their high digital literacy and interest in technology. In addition, gender roles and inclusive communities also encourage wider participation, creating an increasingly diverse and dynamic crypto ecosystem. Here is the explanation:

a. Gen Z and Millennials

According to a recent report from Bitget, a crypto derivatives and copy trading platform, Generation Z, defined as those born between the mid-to-late 1990s and early 2000s, shows the highest interest in copy trading. They account for 44% of all copy trading users in this age group.

Meanwhile, those aged 25 to 35 years account for 32% of all copy traders, followed by those aged 35 to 55 years at 17%, and those over 55 years old, who account for only 7% of the total.

In adoption patterns, Gen Z and Millennials are particularly interested in new technologies and alternative investments. Social media-based communities such as Reddit and Twitter have also sparked interest in crypto adoption among these groups.

Meanwhile, Baby Boomers over the age of 55 are gradually beginning to accept crypto as an investment instrument. Education remains a major challenge in promoting crypto adoption within this group.

b. Gender and Crypto

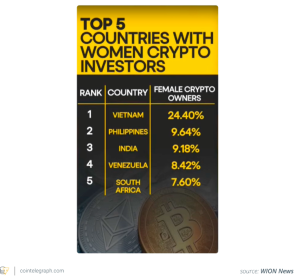

Although cryptocurrency is a relatively new field, male participation has been a hallmark of its first decade. However, in recent years, there has been an increase in female participation within the crypto community. With decentralization being the fundamental principle of blockchain and crypto, there is an opportunity to create a more inclusive financial environment for both men and women.

A research study by crypto exchange eToro in May 2018 revealed that, at the time, female participation in cryptocurrency investment was still low. Male participation accounted for 91.5% of all investors worldwide, while women made up only 8.5%.

However, six years later, there has been significant growth in female involvement, led by Millennials and young Generation Z. This growth also includes women in emerging economies, particularly in Asia, with India and Vietnam at the forefront. By 2023, cryptocurrency ownership data shows that 37% of the 420 million global crypto holders are women, approaching 155 million. Vietnam leads the way with 12 million female cryptocurrency holders, representing 24% of the female population.

Community as the Driving Force of Adoption

The community plays a crucial role in education, discussion, and trust in crypto adoption. While the technological aspect is important, community involvement, feedback, and trust are the primary drivers of successful crypto adoption. There are three key aspects of the community’s role in driving adoption: education, peer-to-peer support, and strengthening social connections.

Local communities significantly contribute to increasing crypto literacy through various activities such as meetups, seminars, and hackathons. In meetups, communities share knowledge about crypto and blockchain. Seminars help people understand the benefits and applications of this technology. Meanwhile, hackathons encourage innovation and real-world solutions. These educational activities effectively introduce crypto and foster its adoption within society.

Peer-to-peer support also plays a critical role. Online discussion groups, such as those on Telegram and Discord, are vital platforms for providing peer-to-peer support in the crypto community. Members exchange information, ask questions, and solve problems together, creating an inclusive learning environment. For instance, communities like Ethereum and Solana have successfully strengthened the adoption of their technologies through active discussions and collaborations on these platforms. Direct support from fellow members accelerates understanding and builds trust in crypto technology.

Communities foster a sense of belonging and trust among their members, forming an essential foundation for supporting crypto adoption. When members feel connected and supported, they are more confident in learning and using new technologies. Strong social connections accelerate the dissemination of information and build trust, driving faster and broader crypto adoption.

Case Study: Successful Crypto Communities

Several communities have successfully raised awareness and adoption of crypto.

a. Binance Community

Binance is a cryptocurrency exchange that allows users to buy, sell, and trade Bitcoin and other cryptocurrencies. Binance has established the Binance Community to build and maintain a global network. It is actively building communities in various countries across Asia, Europe, the Americas, Africa, Oceania, and the Middle East.

The Binance Community is a global network of crypto users who gather both online and in person to support and grow the crypto ecosystem. It is considered one of the most knowledgeable crypto communities in the world.

The Binance Community hosts several activities, including: Member Meet-ups and Events: Community members can connect and share ideas face-to-face, hear from Binance team members, industry experts, and special guests.

b. Ethereum Foundation

The Ethereum Foundation is a non-profit organization based in Zug, Switzerland. Zug is known as “Crypto Valley” due to the large number of blockchain and cryptocurrency organizations located there. The Ethereum Foundation was founded in 2014 by Vitalik Buterin and his colleagues. The organization aims to support the development of Ethereum, a blockchain platform that enables transactions, smart contracts, and decentralized applications (dApps).

The Ethereum Foundation’s main vision is to encourage decentralization and promote innovation in blockchain technology. It is committed to providing the resources developers and the community need to continue innovating.

The Ethereum Foundation plays several important roles in supporting the growth and development of the Ethereum ecosystem. Some of its main roles include: Ethereum Technology Development, Grants, and Devcon Organizer.

c. Local Community (PINTU in Indonesia)

PINTU is an Indonesian crypto asset trading and investment application managed by PT Pintu Kemana Saja. This application is registered with and supervised by the Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI).

PINTU has a community called the PINTU Community, composed of PINTU application users who can collect non-fungible tokens (NFTs). This community focuses on local education and ecosystem development in Indonesia. It also has a loyalty program called the Pintu Community NFT.

Conclusion and Recommendations

Communities play a vital role in driving cryptocurrency adoption by facilitating education, discussions, and building trust among users. Various activities such as meetups, seminars, and hackathons serve as effective educational platforms to increase crypto literacy within the community. Through these activities, communities help individuals understand the benefits of blockchain technology and how to use it effectively.

In addition, peer-to-peer support in online discussion groups, such as Telegram and Discord, allows members to share information, solve problems together, and encourage collaboration. Real examples can be seen in the Ethereum and Solana communities, which have succeeded in increasing the adoption of their technology through active discussions and collaboration on these platforms.

The influence of communities also extends to demographic and regional aspects, where local communities play a vital role in addressing the specific needs of each region. In Latin America, communities help address inflation challenges through education on the use of cryptocurrency as a hedge. In Southeast Asia, social media-based communities strengthen adoption among tech-savvy Gen Z and Millennials.

Meanwhile, in Africa, local communities focus on financial inclusion by providing access to alternative financial systems. By integrating a community-based approach, cryptocurrency adoption becomes more inclusive and relevant, reflecting the unique needs of each demographic and region.

To strengthen the crypto community, educational initiatives need to be enhanced through seminars, workshops, and online discussions that can reach various levels of society. This will help improve crypto literacy, especially in regions where adoption is growing rapidly, such as Southeast Asia and Africa. Inclusive education can attract more participation from various demographic groups, including the younger generation and women. This can create a more diverse and dynamic community.

In addition, collaboration across regions and demographics can expand the scope of cryptocurrency adoption globally. Interaction across communities allows for the exchange of ideas and best practices to drive innovation. Communities need to actively create an inclusive environment that supports open discussions and builds trust among members. This step can increase adoption while also strengthening crypto’s position as a relevant alternative financial tool in various regions of the world.