Introduction

The year 2024 marked a historic turning point for the crypto trends. Bitcoin (BTC) surpassed $100K in December, marking the peak of a year filled with ups and downs. Beyond BTC prices, the cryptocurrency market has reached a critical milestone with various emerging crypto trends. Communities have played a crucial role in the development of these trends.

In this report, AllSpark Research will analyze how communities will play a pivotal role in shaping the direction and future of the crypto market in 2025. The article focuses on four major trends highlighted in the 2025 Crypto Market Outlook report released by Coinbase. Four key areas have been identified as the main drivers of the future crypto market: Stablecoins, Tokenization, Crypto ETFs, and DeFi. Below is a detailed explanation:

Key Trends Shaping the Future of the Crypto Market

A. Stablecoins: The Foundation for Crypto Ecosystem Growth

Stablecoins are crypto assets pegged to other assets, such as fiat currencies or gold. Unlike other crypto assets with volatile values, stablecoins maintain a constant value over time. Stablecoins have become a critical foundation within the crypto ecosystem.

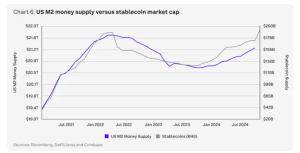

The market capitalization of stablecoins grew by 48% in 2024, reaching $193 billion as of December 1. Some analyses even suggest that stablecoin market capitalization has surpassed $200 billion, driven by crypto trading and non-crypto uses such as payments and remittances.

This year, stablecoins processed over $27 trillion in transactions, three times more than in 2023. According to Coinbase analysis, the market capitalization of stablecoins could reach $3 trillion within five years, making them a vital part of the global financial system.

The stablecoin user community, particularly through the adoption and innovation of new applications, could accelerate the integration of stablecoins into global payment systems. Furthermore, local communities and stablecoin projects collaborate on various initiatives to increase public awareness and understanding of stablecoins. These initiatives aim to build trust and promote the use of stablecoins.

Several examples of initiatives by stablecoin communities and projects include hosting workshops, webinars, and community outreach programs. Another initiative involves creating academies to provide free digital asset courses. An essential initiative includes utilizing SMS transactions to facilitate payments for underserved communities.

B. Tokenization: Transforming Real-World Assets

Tokenization, especially real-world asset (RWA) tokenization, grew by more than 60% in 2024, reaching $13.5 billion. This includes traditional applications such as U.S. Treasury bonds and money market funds. Tokenization has also expanded into areas such as private credit, commodities, corporate bonds, real estate, and insurance.

Coinbase predicts that sustained investment and technological refinement will position tokenization as a core pillar in the current market cycle, revolutionizing portfolio construction and investment processes.

Tokenization to be the crypto trends in 2025. The crypto community can play a significant role in the adoption and development of tokenization projects. A community-based approach to promoting asset-backed tokens, such as real estate and commodities, will create higher demand and expand the ecosystem.

Real-World Asset Tokenization refers to the process of transforming physical assets into tokens recorded on the blockchain to facilitate easier trading and ownership. The advantages of RWA tokenization include increased liquidity, reduced costs, and improved transparency and accessibility, all of which benefit communities.

C. Crypto ETFs: Impact on Institutional ParticipationThe launch of spot Bitcoin ETFs in the US in 2024 has had a significant impact on crypto, increasing institutional participation. Institutional investors such as pension funds and hedge funds are now leveraging these ETFs, creating stable demand for crypto. The approval of Bitcoin- and Ether-based ETPs and ETFs in the US recorded a net inflow of $30.7 billion within 11 months, far surpassing the $4.8 billion (inflation-adjusted) achieved by the SPDR Gold Shares ETF in its first year in 2004.

These products rank in the top 0.1% of 5,500 ETF launches over the past 30 years. The ETF has also driven Bitcoin’s dominance from 52% at the beginning of the year to 62% by November 2024. Additionally, US-regulated options for these products are expected to strengthen risk management and provide more efficient exposure.

Looking ahead, spot ETFs for other assets such as XRP, SOL, LTC, and HBAR have the potential to expand the market. However, despite rumors about an XRP ETF, BlackRock’s head of ETFs denied any plans for this. While BlackRock dismissed the filing, speculation about the potential launch of an XRP ETF by the asset manager persists. Meanwhile, other asset managers like Canary Capital, Bitwise, WisdomTree, and 21Shares have already filed XRP ETF applications with the SEC.

On the other hand, the community and institutions play complementary roles in creating stable demand and liquidity. The community can also influence ETF-related regulations through their voices in public forums and collective decision-making.

For example, Brian Kelly, CEO of the digital asset investment firm BKCM, highlighted the potential of Solana. He mentioned that Bitcoin, Ethereum, and Solana are the top three crypto assets for this cycle. Kelly also argued that if the SEC eventually approves a spot Ethereum ETF, it would provide clearer regulations for Ethereum and the broader market. This could potentially lead to the approval of more spot crypto ETFs, including Solana.

D. DeFi: Decentralized Finance and Innovation

Decentralized Finance (DeFi) is experiencing a resurgence. Lending protocols are reaching record highs in Total Value Locked (TVL), while decentralized exchanges (DEXs) are capturing an increasing share of trading volume.

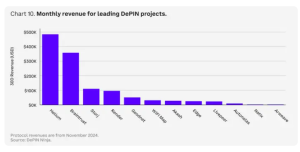

Coinbase noted that innovative applications such as Decentralized Physical Infrastructure Networks (DePIN) and prediction markets are leveraging DeFi’s core principles to provide new user experiences. Regulatory changes and advances in on-chain verification are also paving the way for greater institutional involvement.

DePIN has the potential to transform real-world resource allocation by building resource networks more efficiently. For example, Helium rewards local hotspot providers with tokens to create a coverage map without the high costs of building cellular towers. DePIN projects span computing, cellular towers, and even energy, offering more resilient and cost-effective solutions.

However, sustainability and long-term revenue must be evaluated on a case-by-case basis. Decentralization strategies may not always suit every industry, as network adoption, token utility, and revenue heavily depend on the targeted sector.

The community plays a critical role in DeFi development. The DeFi community will continue to innovate, drive adoption, and refine DeFi protocols. DeFi’s success heavily relies on community collaboration in building and testing applications and supporting decentralized infrastructure.

DeFi is grounded in principles that empower individuals to manage and access financial services without intermediaries like banks or traditional financial institutions. By leveraging blockchain technology, DeFi opens opportunities for communities to engage more directly in financial systems, enabling easier, fairer, and more transparent access.

The Role of Communities in Supporting and Driving Innovation

A.Collaboration and Contribution

Crypto communities have the power to drive innovation by collaborating on the development of new projects. For instance, accelerator programs like Circle Ventures provide a direct pathway for startups to gain tailored support and advice relevant to their projects. This approach helps establish more reliable mechanisms to support innovation amid market fluctuations.

Additionally, cross-industry collaboration between blockchain and technologies such as artificial intelligence (AI) and decentralized physical infrastructure (DePIN) demonstrates significant potential. Analysis suggests that the combination of AI and blockchain could add $20 trillion to global GDP by 2030 through various applications such as data tracking and governance. Furthermore, communities can actively create forums, discussion groups, hackathons, and open-source code contributions to accelerate innovation across crypto trends.

Communities can support individuals by connecting them with fellow developers and software enthusiasts. Within these communities, individuals can share stories, seek advice on technical questions, and find mentorship, enabling them to collectively accelerate innovation across every crypto trend.

B. Education and Outreach

Communities play a significant role in spreading knowledge and enhancing understanding of blockchain technology, DeFi products, and tokenization. Broader education leads to greater market acceptance of these technologies.

Several international organizations provide cryptocurrency education for both beginners and professionals. One example is the CryptoCurrency Certification Consortium (C4). C4 offers certification programs for professionals looking to advance their knowledge in cryptocurrency and blockchain. Programs such as the Certified Bitcoin Professional (CBP) and Certified Ethereum Developer (CED) are notable examples.

Another example is Blockchain Council. The Blockchain Council is an organization that offers various courses and certifications in blockchain, cryptocurrency, and related technologies. They provide learning materials for all knowledge levels, from beginners to advanced learners. These organizations deliver broader education that benefits the community.

C. Involvement in Regulatory Decisions

Crypto communities can play a role in the regulatory process by voicing their opinions and supporting policies that benefit the crypto ecosystem. This includes participating in public consultations and sharing their experiences with policymakers.

One way for communities to participate is by joining public consultations organized by government agencies or regulators. In these forums, community members can present their views on proposed regulations and provide explanations based on their experiences in transacting or managing crypto assets. For example, during consultations related to tax regulations for crypto, industry players could share how more flexible rules could foster innovation without disadvantaging them.

For instance, in Europe, crypto communities often collaborate with organizations such as Blockchain for Europe to influence more pro-crypto regulations, as seen in discussions about MiCA (Markets in Crypto-Assets Regulation) proposed by the European Union. By sharing their experiences and perspectives, communities can help shape fairer regulations that support the growth of the crypto sector as a whole.

Challenges Faced by Communities in Addressing Crypto Trends in 2025

A. Security and Trust

With the increased use of stablecoins and tokenization, communities must tackle challenges in ensuring transaction security and managing risks related to potential fraud or technological issues. Communities can experience greater security in transactions, as stablecoins are designed to maintain stable value, reducing uncertainties associated with cryptocurrency price fluctuations.

Users, including investors and DeFi enthusiasts, can confidently utilize stablecoins as safe and stable instruments without worrying about disruptive volatility. Additionally, RWA (Real World Asset) tokenization enables more people to participate in owning real-world assets such as properties or artwork, which were previously limited to a select few. This opens opportunities for a broader community to engage in investments, making them more inclusive and accessible.

B. Differences of Opinion Within the Community

The role of the community also involves managing differing opinions on innovation, regulation, and adoption. These differences must be addressed to synergize efforts for the growth of the cryptocurrency ecosystem. Some parties, such as projects like Bitcoin, Ethereum, and various DeFi (Decentralized Finance) initiatives, favor decentralization and transaction freedom.

Meanwhile, others, like the Federal Reserve (US) or financial institutions like JPMorgan, advocate for stricter regulations to prevent misuse. Some believe regulations hinder innovation, while others argue that regulations are essential for ensuring market security.

Furthermore, debates also arise regarding the broader adoption of cryptocurrencies. For example, this is evident in the dynamic between government authorities like the Securities and Exchange Commission (SEC) and technology entrepreneurs such as Vitalik Buterin. Some believe mass adoption will occur over time, while others feel there needs to be a strategic effort from governments or financial institutions. These differences require collaboration among communities, regulators, and financial institutions to ensure harmonious growth of the cryptocurrency ecosystem.

C. Uncertain Regulatory Issues

The cryptocurrency community must work together to influence policies that support the industry and ensure that regulations do not stifle innovation. Government regulations can impact the demand and supply of cryptocurrencies. This can occur because governments have the authority to regulate, impose taxes, or even ban cryptocurrency activities, which usually leads to a decline in cryptocurrency prices.

The United States has legalized the trading of cryptocurrency assets on crypto exchanges, although not as an official currency. The US legislative body has repeatedly sought to regulate cryptocurrency assets out of concern that these currencies could undermine the dominance of the US Dollar in the global economy and the impact of cryptocurrency assets when held in large quantities by individuals and institutions. Now, after Donald Trump has been elected as President of the United States, the community is optimistic that regulatory policies related to cryptocurrency will become more lenient.

Conclusion

The crypto industry enters 2025 at a crossroads of regulatory, technological, and market evolution. Coinbase’s report asserts that this year could be a turning point that determines the long-term future of the industry. The community play a crucial role in this turning point.

A. The Crucial Role of the Community

In 2025, the crypto community will be key to driving adoption and innovation in technologies such as stablecoins, tokenization, crypto ETFs, and DeFi. They will accelerate the spread of new technologies and influence regulations through active participation in public consultations, ensuring policies support the sector’s growth.

The main challenges faced include addressing security issues, differing views on decentralization versus regulation, and regulatory uncertainty. The success of the crypto market will depend on collaboration between the community, regulators, and the industry to create a safe and sustainable ecosystem.

B. Future Predictions

In 2025, the future of the crypto market is predicted to be more inclusive, decentralized, and sustainable, thanks to the active role of the community. Innovations in stablecoins, tokenization, and DeFi will accelerate blockchain integration into the global financial system. Community collaboration in project development, education, and influence on regulations will foster a more transparent and fair market.

Challenges such as transaction security and regulatory uncertainty remain. Differences of opinion within the community may also affect the market’s direction. Cooperation between the community, regulators, and financial institutions is key to ensuring market growth.