Introduction

Meme coins are cryptocurrencies created based on memes or specific humorous themes. Meme coins are also known as a form of digital communication that is rapidly developing and influencing the patterns of interaction and engagement within online communities.

In this Research Report article, AllSpark Research (ASR) draws from the HTX Ventures report titled 2024 Meme Sector Analysis: From Viral Spread to Ecosystem Beachhead. This report highlights the current status and characteristics of the meme coin sector’s development in 2024. The report primarily discusses meme coin trends, the rise of platforms, spreading methods, and market strategies.

This ASR report highlights the role of communities in enhancing meme coin virality through distribution strategies and trends. The aspects discussed in this article include The Rise of Meme Coins in 2024, Role of Meme Platforms in Community Growth, and Liquidity, Investment Strategies, and Institutional Influence. Here’s a further explanation.

The Rise of Meme Coins in 2024

A. Meme Coin Trends in Q1 and Q2 2024

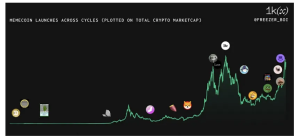

According to HTX Ventures, in 2024, the meme coin market experienced a surge, particularly at the beginning of the year and during the second quarter. Unlike previous meme coin trends that were short-lived, meme coins became highly popular in this round, especially from February to April 2024. There was a weekly surge of an average of six times in 20 popular coins, such as PEPE, or the fastest listing records on CEX by coins like WIF and BOME, a clear message to cryptocurrency investors.

Several factors contributed to the explosion in meme coin popularity. These factors include social media and community dissemination, which often show exponential growth. Another factor is the influence of influencers and the phenomenon of Fear of Missing Out (FOMO). Users with large fan bases can accelerate the spread of memes significantly, thus expanding their influence.

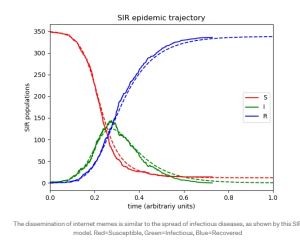

The spread of meme coins can occur due to various reasons, relying on close interpersonal relationships and interactions, as shown in the image below. The spread of meme coins on the internet is similar to the spread of infectious diseases, as shown by this SIR model. Red = Susceptible, Green = Infectious, Blue = Recovered.

The spread of meme coins is often marked by exponential growth. Initially, only a few people are exposed to meme coins, but these coins reach a wide audience after a short period. Additionally, the spread of meme coins is also influenced by network hubs, which are very similar to the “super spreaders” of diseases.

B. Mechanism of Meme Coin Spread through Social Media

Platforms like Twitter, Reddit, Telegram, and Discord are often used as primary channels for the distribution and promotion of various crypto projects, especially meme coins. Crypto communities utilize these platforms to build hype, distribute information, and engage with community members.

In addition to platforms, social media algorithms also support the distribution and promotion of meme coins. These algorithms prioritize content that is frequently liked, shared, or commented on by the community. The algorithms take into account various factors such as content type, post date, user activity, and interactions between accounts.

There are case studies of meme coins going viral due to tweets or community trends. For instance, projects like Bonk ($BONK) on the Solana blockchain. This meme coin, launched in December 2022, successfully built a large fanbase with over 760 thousand followers on social media. They used platforms like Discord, Reddit, Telegram, and Instagram to create hype and distribute information to their community.

A more recent case study is the meme coin $TRUMP. The $TRUMP meme coin is a crypto token launched by elected President Donald Trump on January 18, 2025, on the Solana blockchain. The token went viral on social media and attracted significant attention from retail investors and the crypto community, largely due to Trump’s global recognition and the cultural appeal of meme coins.

$TRUMP has experienced significant price volatility since its launch. At its peak, the token reached a market capitalization of nearly $50 billion, with Trump owning 80% of the total token supply.

C. The Role of Platforms in Meme Coin Distribution

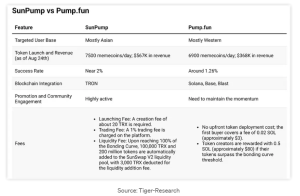

One of the prominent features of the rise of the meme coin sector is the launchpads for meme coin releases. Currently, two popular meme coin launchpads are Pump.fun and SunPump. Both platforms have simplified the process of creating and trading meme coins while integrating smoothly with major blockchains, attracting a substantial user base.

Pump.fun primarily serves Western audiences, while SunPump, owned by Justin Sun, is more popular in Asia. At the same time, SunPump’s strong marketing on platforms like X, driven by Sun and his team, has made it stand out on TRON.

The presence of meme coins on launchpads is often compared to the adoption of meme coins on centralized exchanges (CEX) and decentralized exchanges (DEX). Popular meme coins like DOGS ($DOGS) and Myro ($MYRO) are typically more easily adopted on CEXs due to high liquidity and broader user accessibility. CEXs also offer features like margin trading and staking, which can increase demand for meme coins. However, due to their centralized nature, CEXs implement strict regulations, meaning not all meme coins can be listed easily.

Meanwhile, DEXs allow anyone to create and trade tokens without approval from a centralized entity. This makes DEXs the main platform for initial meme coin launches, such as Dogecoin ($DOGE) and Shiba Inu ($SHIB), before they gain enough popularity to enter CEXs. However, liquidity on DEXs is often lower than on CEXs and launchpads, causing meme coin prices to be more volatile.

Role of Meme Platforms in Community Growth

A. Analysis of Meme-Based Asset Platforms

Launchpads like Pump.fun and SunPump play a crucial role in the creation and launch of meme coins. Both platforms are unique in areas such as user positioning, daily issuance, profitability, project success rates, ecosystem integration, marketing, and community engagement. Generally, these platforms make it easier for creators and communities to create new tokens.

Although it was launched later, SunPump generated around $567K in revenue by the end of August, with approximately 7,500 meme coins being issued daily. Meanwhile, Pump.fun, which issues around 7,000 coins daily, is not far behind. Both SunPump and Pump.fun charge a 1% exchange fee.

Launchpads have mechanisms designed to attract communities and enhance user engagement through various strategies such as staking systems, exclusive whitelists, and token-based incentives. By offering early access to potential projects, launchpads create ecosystems that encourage active participation from both investors and developers. Additionally, features like governance voting and reward programs further strengthen community loyalty, making launchpads essential tools in supporting the growth of crypto projects at an early stage.

B. User Demographics, Revenue Models, and Ecosystem Integration

Investors and traders of meme coins on platforms like SunPump and Pump.fun can be divided into two main groups: speculators and loyal community users. Speculators are attracted to quick profits that can be made from price fluctuations in meme tokens, but they do not focus on the long-term value of the project. On the other hand, loyal users are more focused on the community and the entertainment aspects of meme coins. [1]

SunPump and Pump.fun generate most of their revenue through transaction fees charged to users when creating or trading meme coins. On SunPump, the token creation fee is 20 TRX for each meme coin launched, which becomes one of their revenue sources.

SunPump is directly integrated with the TRON blockchain, known for its high transaction speed and low costs, allowing for faster and cheaper transactions compared to other platforms. In contrast, Pump.fun uses the Solana network to accommodate high transaction volumes. Pump.fun has faced criticism from the community because many of the meme coin projects launched on the platform fail to sustain themselves. Both platforms leverage decentralized blockchains to provide a more open environment, but with certain risks for their users.

C. Impact of Platforms on Community-Based Investment Trends

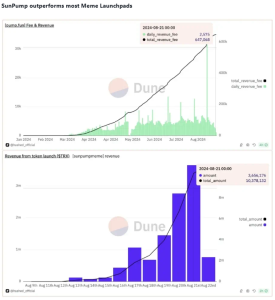

SunPump attracted 25,000 tokens and generated $1.5 million in the first 10 days, thanks to the support of Justin Sun. Meanwhile, despite facing criticism, Pump.fun still generates $348.5 million annually and has launched 1.6 million meme coins. The success of both SunPump and Pump.fun has contributed to community growth, as more people can easily launch meme coins.

The metrics below show the rapid growth of SunPump, with total revenue from Pump.fun reaching $647,068 and the launch of $TRX tokens generating $10,378,132 on August 21, 2024, confirming its dominance among meme launchpads.

Psychological factors like Fear of Missing Out (FOMO) drive investment in meme coins, as seen on SunPump, where tokens like Sundog reached a capitalization of $53.4 million in a short period. This relatively large capitalization in such a short time helped create hype that attracted many investors and community members.

On the other hand, communities can be likened to a coin with two sides. The community plays a role in supporting or even bringing down meme coin projects. Communities have significant influence, as seen on SunPump, which is driven by the TRON community. In contrast, Pump.fun has faced strong criticism for allegedly harming investors. These two cases highlight the importance of community support for platform success.

D. Legal Lawsuit and Community Reactions

Amidst heavy criticism, Pump.fun is facing a legal lawsuit over allegations of selling illegal securities. Diego Aguilar has filed a lawsuit against Baton Corporation and its three founders in the Southern District of New York, accusing them of offering tokens that should have been registered as securities. Aguilar claims to have suffered losses after investing in meme coins that were promoted with misleading promises of significant profits. [2]

The lawsuit also criticizes Pump.fun’s marketing strategy, which targets young users through social media, creating a FOMO phenomenon with promises of huge profits. Despite facing legal challenges, Pump.fun continues to generate significant revenue, reaching US$493 million since January 2024. Pump.fun had previously faced a class action lawsuit related to the PNUT and HAWK tokens.

Community reactions to the lawsuit against Pump.fun have been varied. Most investors and users who feel wronged have welcomed the legal action, hoping to seek justice for the losses they experienced. Many of them feel deceived by the claims of big profits and the aggressive marketing that used social media to create FOMO.

However, there are also opinions from the community that are more critical of the legal action, with some questioning whether the lawsuit will affect the future of Pump.fun and innovation in the crypto space as a whole. Meanwhile, others argue that this development could worsen the image of the crypto industry, which has often been viewed skeptically by the general public and regulators.

Liquidity, Investment Strategies, and Institutional Influence

A. The Role of Meme Coins as an Entry Point into the Blockchain Ecosystem

Meme coins have become a major entry point for retail investors into the crypto world, thanks to their affordable prices and community appeal. Promotions through social media and celebrities attract the attention of newcomers, allowing them to engage in the blockchain ecosystem without technical barriers. For example, the success of meme coins like $Foxy and $Degen has also boosted liquidity and introduced users to various DeFi and NFT products.

The adoption of meme coins has supported the growth of the DeFi and NFT ecosystems, with users starting to explore other blockchain applications. For instance, $Degen on Base serves as a tipping coin, creating opportunities for the community to participate in staking and NFT transactions. In this way, meme coins facilitate the transition to more complex blockchain products, accelerating the adoption of crypto technology.

B. Investment Strategies and Their Impact on Market Liquidity

In the meme coin market, three strategies are commonly used: HODL, scalping, and swing trading. HODL relies on long-term holding for potential large profits, scalping focuses on quick profits through small transactions, and swing trading seeks profit from significant price movements over several days or weeks. All three differ in risk and potential return.

On the other hand, meme coin prices are heavily influenced by hype, market sentiment, and news. Rapid changes in sentiment or major announcements can cause sharp price fluctuations, making the meme coin market more volatile.

Additionally, there is a difference in investment patterns between retail investors and whales in the meme coin ecosystem. Retail investors tend to buy based on hype and trends, while whales invest in large amounts to influence prices and often aim for long-term or large profits.

C. Institutional Participation and Changes in Trading Patterns

Meme coins play an important role in the development of the crypto ecosystem by driving liquidity and participation from various parties. First, major meme coin foundations, support programs, and community initiatives are becoming stronger, contributing to the growth of meme coins in every ecosystem. Many large projects and chains, such as Linea, Base, and Avalanche, have begun to build this foundation, introducing support programs like grants and meme coin promotions that incentivize developers and users.

Second, the involvement of venture capital (VC) investors is also increasing. Starting in the second half of 2024, many VCs have expressed interest in investing in meme coin infrastructure, marking a significant shift in how meme coins are accepted by the market. This indicates that the sector is not only driven by individual speculation but is also gaining attention from major players who can accelerate the further development and adoption of meme coins.

Third, as more liquidity is created, new supporting mechanisms will emerge. With interest rates expected to decline, the meme coin ecosystem will develop more effectively. Secondary meme coin-based products, such as meme creation platforms, management tools, and meme coin-based transactions, will become more popular. This creates a more supportive environment for meme coin growth, allowing them to survive in the long term and expand their influence in the crypto industry.

Conclusion

A. Summary of Key Findings

Meme coins play a major role in shaping the dynamics of digital communities. Meme coins have become not only an entertaining phenomenon but also have impacted how digital communities interact. The popularity of meme coins in 2024, especially through social media and community platforms like Reddit, Telegram, and Discord, demonstrates how memes can unite individuals to share interests and ideas. These communities actively distribute information and create hype, accelerating the adoption of meme coins worldwide, with significant influence from community campaigns and influencers.

Additionally, although often seen as a short-term phenomenon, meme coins have played a crucial role in introducing blockchain technology to a wider audience. The success of meme coins like $BONK and $TRUMP helped attract retail investors and introduce them to other blockchain products, including DeFi and NFTs. The spread of these meme coins has led to increased liquidity and accelerated the adoption of more complex blockchains, making them more accessible to new users.

On the other hand, meme coin-based platforms have become a major catalyst in the growth of communities. Platforms like Pump.fun and SunPump play a key role in the distribution of meme coins and the development of the crypto community. They provide spaces for users to easily create and trade meme coins, which in turn drives greater engagement in the ecosystem. By offering features like staking, exclusive whitelists, and token-based incentives, these platforms strengthen community loyalty and boost active participation.

B. Long-Term Implications for Blockchain and Digital Communities

The crypto community can leverage memes to boost adoption by spreading awareness of meme coins through social media. Meme coins that are attention-grabbing and humorous have the potential to motivate more people to join the crypto world, especially retail investors attracted by affordable prices and viral phenomena. Furthermore, meme coins can create conversations that are easier to understand, bringing blockchain technology closer to the general public and accelerating adoption.

In addition to increased adoption, there are both positive and negative impacts from viral meme trends. The virality of memes can have a significant positive impact on the blockchain industry, such as increasing awareness and higher liquidity. However, there are risks associated with high price volatility, excessive speculation, and potential project failure if the hype built around them is not backed by real value or good management. A highly engaged community can be a driving force, but it can also lead to get-rich-quick schemes that harm investors.

Meme coins are likely to continue to exist, but their future depends on how well they can evolve beyond the speculative cycles that currently dominate. Some meme coins may survive by building real value and a more solid ecosystem, while others may only be part of a short-term phenomenon. Broader adoption trends and engagement from both the community and large institutions can help meme coins evolve into assets that are more integrated into the blockchain ecosystem.